Looking to step into the world of home ownership? You're likely keeping a close eye on mortgage rates, especially if recent hikes have pressed pause on your plans. Last year, when rates flirted with the 8% mark, many potential buyers found the math just didn't stack up with their budgets. If you're nodding along, you're far from alone.

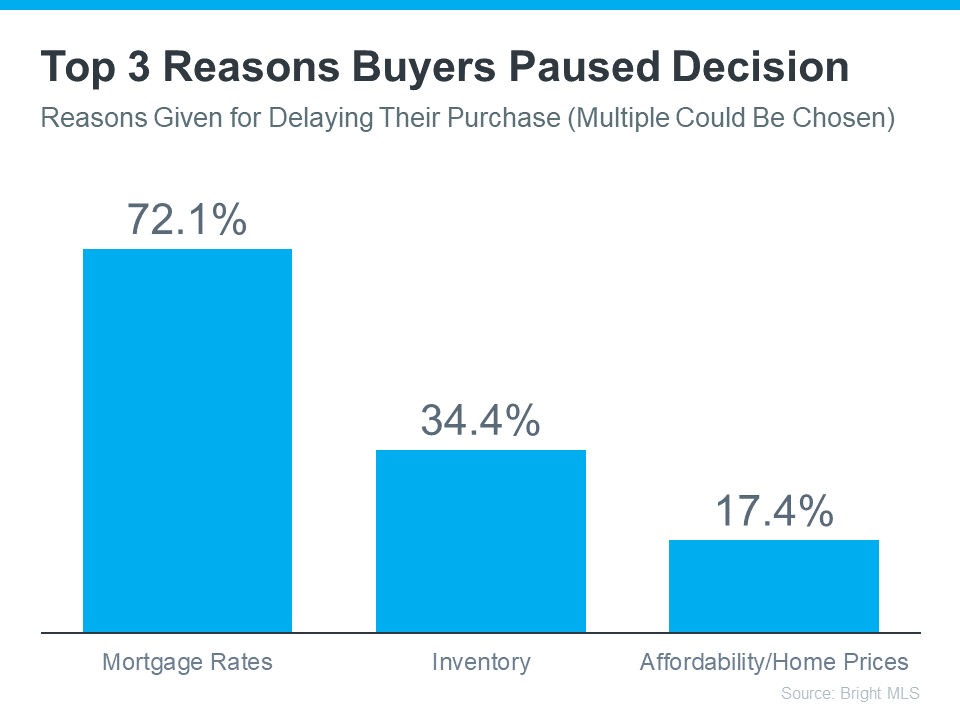

Bright MLS highlights that soaring mortgage rates have been the number one deal-breaker for buyers, putting a damper on moving aspirations. This insight is visually captured through a striking graph of blue rectangles, each representing the chill of waiting for better rates.

David Childers, CEO of Keeping Current Matters, sheds light on this sentiment in the "How’s The Market" podcast, stating,

"Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”"

The reason for this shift? Mortgage rates have retreated from their peak last October, with predictions pointing to a continued decrease throughout the year, especially if inflation is reined in. Experts are even forecasting rates to dip below 6% by the year's end—a potential game-changer for many.

A Realtor.com article echoes this optimism, revealing that

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

While forecasting mortgage rates is notoriously challenging, the current expert consensus offers a glimmer of hope. If you've been on the sidelines, it might be time to reconsider your stance. Reflect on the question: At what rate would I feel comfortable reigniting my home search? Whether it's 6.5%, 6.25%, or the dreamy sub-6% mark, having a figure in mind is the first step.

Once you've set your target, the next move is to partner with a local real estate expert. They'll keep you in the know about market movements and signal when rates align with your ideal scenario.

Bottom Line

Have high mortgage rates put your home buying on ice? Pinpoint the rate that'll prompt you to re-enter the market. With this number in mind, let's connect. Together, we'll ensure you're ready to make your move when the rates are right.

Considering diving back into the housing market? Reach out, and let's turn your home-owning dreams into reality. Don't forget to follow us for more updates!